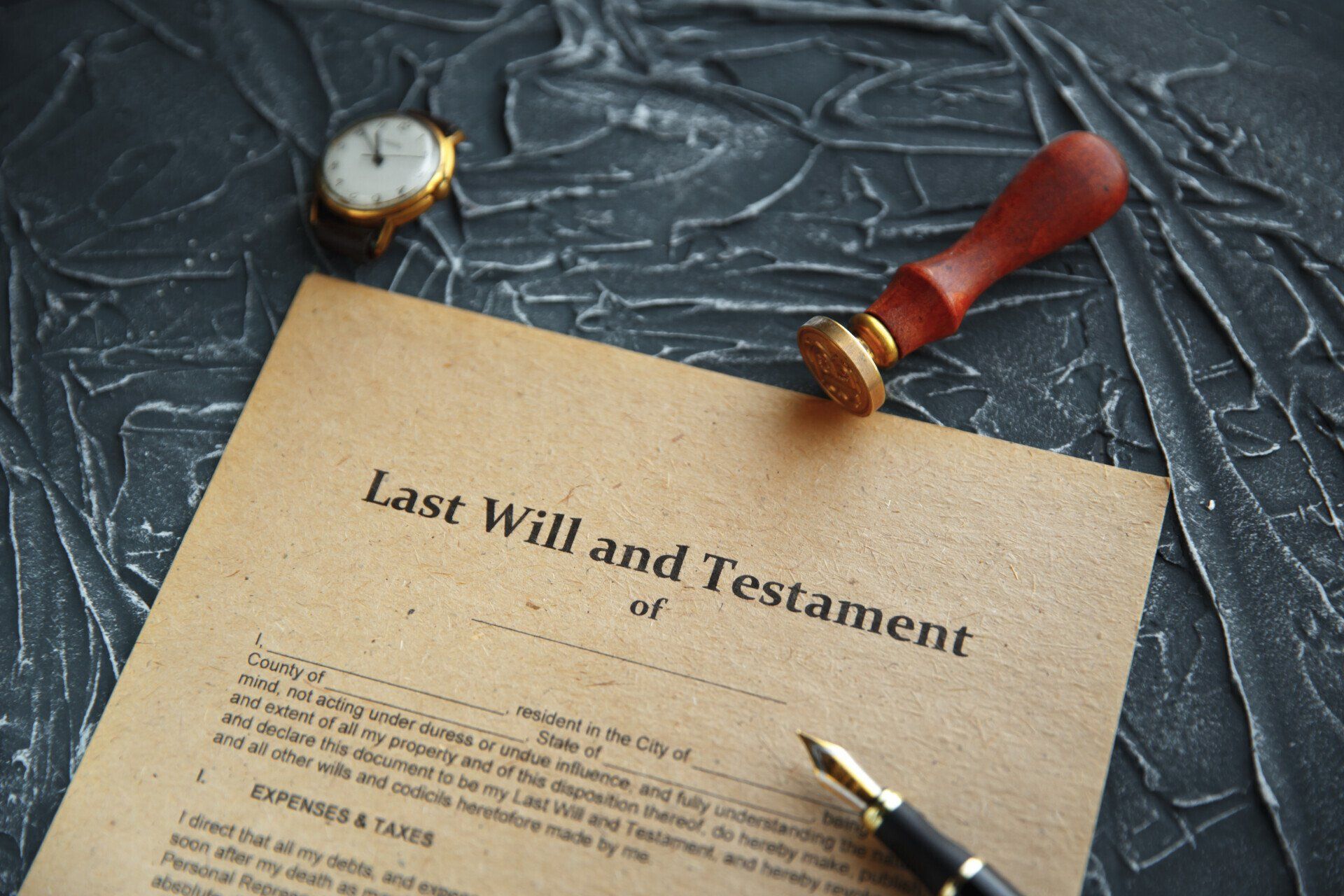

Have You Catered for Your Digital Presence in The Estate Plan?

These days, a Florida resident’s online presence is as, if not more, important than their actual physical presence. According to some experts, someone under the age of 70 most likely has 160 digital accounts. Keeping track of these accounts, passwords and information is tricky enough when one is doing it him or herself, but what happens if someone passes away without disclosing all necessary information for accessing and protecting these accounts to loved ones?

What Are Digital Assets?

In their simplest form, digital assets contain information stored in an electronic record. This could be on the computer, cloud, memory sticks or online. This means pictures, reward points, banks, cryptocurrency, digital collectibles, social media activity, e-books, music libraries, websites, personal information—the list can go on and on, depending on one’s individual circumstances. Given how important one’s digital assets are, it is important to include provisions in one’s estate plan on how they can be accessed, controlled and protected.

Including Digital Assets in The Estate Plan

One should consider making an inventory of their accounts and assets to make it easier for beneficiaries to know where to find them and how to access them. Otherwise, access can be lost while loved ones try to discover accounts and passwords. Its important to keep in mind that a simple will may not be enough to protect an individual’s digital life and assets. While it should definitely be a starting point and define what digital assets are and who the beneficiaries are, that is not enough. Someone else accessing personal information might result in a violation of service agreements or state laws. Similarly, family members may not know how to handle the decedent’s social media presence after their demise.

A digital estate plan is just as important as a physical one, especially as more and more information migrates online. While it is convenient to think loved ones can manage everything on their own, without proper instructions and access that conforms to state law, one’s digital assets may be lost or invaluable time and effort lost trying to gain access to them. An experienced attorney can explain the nuances involved in creating a comprehensive estate plan.