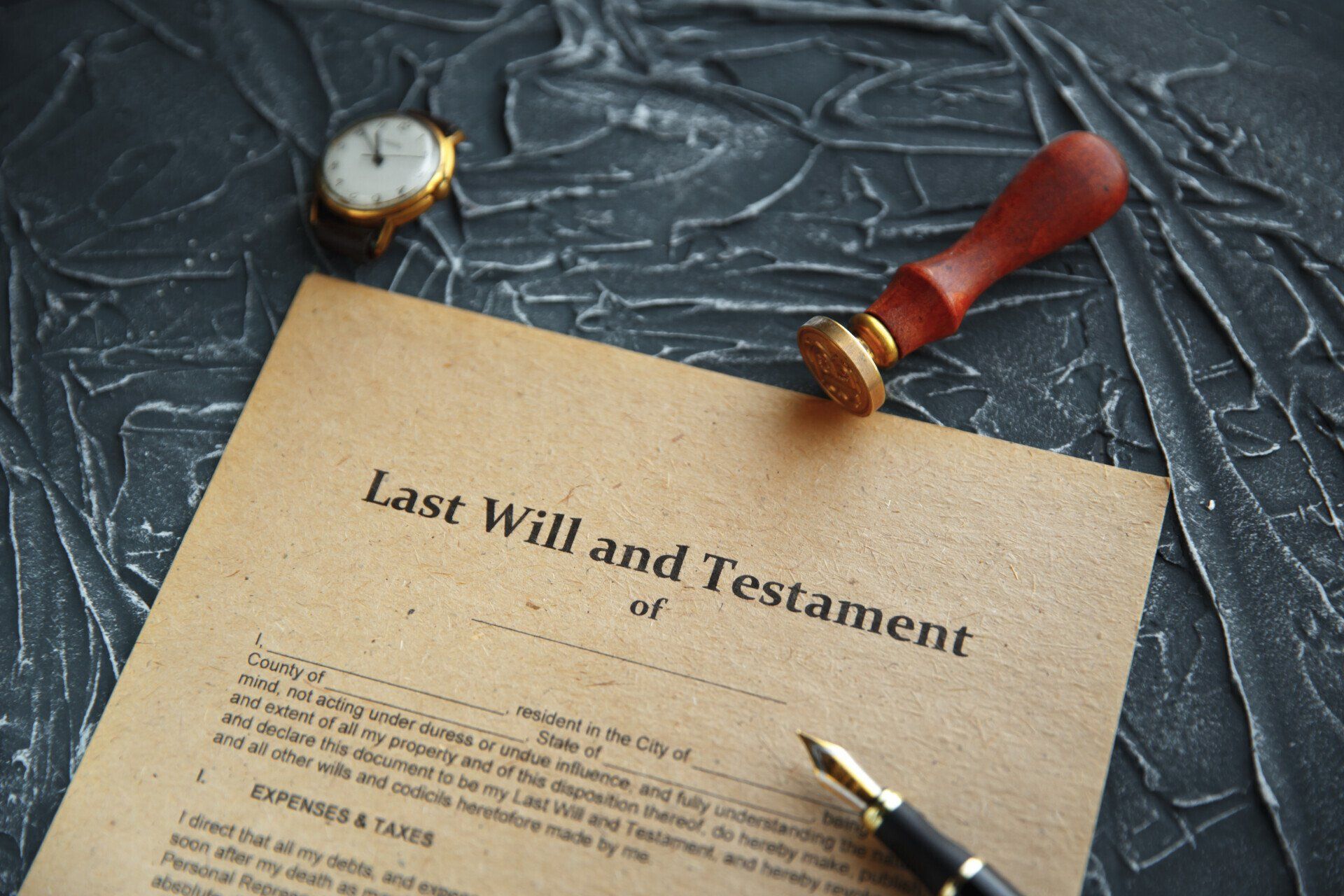

Reasons Why Your Estate Might Be Subject to Probate

If you are a Florida resident when you die and own any property in your own name without naming a beneficiary, your estate will be subject to administration, also known as probate. This is generally true whether you die with or without a valid will. A probate proceeding may also need to be initiated if you own real estate with another person. However, probate may be avoided by owning property in a revocable living trust.

What Happens During a Probate Proceeding?

The overall goal of probate is to transfer assets from your estate to beneficiaries as directed in your will or in accordance with state intestacy laws. State intestacy laws will also likely determine who gets your property if your will is found to be invalid.

What Happens if A Beneficiary Dies Before You Do?

In most cases, you must name your spouse as the beneficiary of a 401(k). If they were to die before you do, the asset would go back into your estate, assuming that there were no alternate beneficiaries with a claim to it.

Ownership Rights to A Home Can Be Passed Through a Will or Trust

If a home is titled as a tenancy in common, your ownership interest in that property isn’t necessarily acquired by the other owner or owners. Instead, you have the option of passing it to an adult child or anyone else who is legally allowed to receive and own property. In the event that the ownership interest is placed in a trust, there would be no need for probate as it is not being held in your estate.

A probate administration attorney may help you learn more about what the process entails. This attorney might review your will or other estate plan documents to determine if they adhere to state law. He or she may also answer any questions that your estate representative has about how to settle your affairs in a timely manner.