Young Adults and Estate Planning: Grasping the Basics Sooner

Young adults in their 20s and 30s who are interested in finding out more about estate planning in Florida are setting themselves up for a secure future for their families and themselves. By getting his or her affairs in order at an early age, an individual is more likely to be prepared for both the inevitable and unpredictable. Here is some information about the basics of estate planning.

Durable power of attorney is a document that gives a family member or a third party the ability to make decisions on behalf of an individual in case he or she becomes incapacitated in some manner. Businesspeople set this up when they travel, for example. While they are abroad, their assigned representatives have the power to complete transactions on their behalf.

A living will is a document that gives a family member or a third party the power to make medical decisions on behalf of someone in case he or she becomes incapacitated. This is commonly used when individuals are in a coma for an extended period.

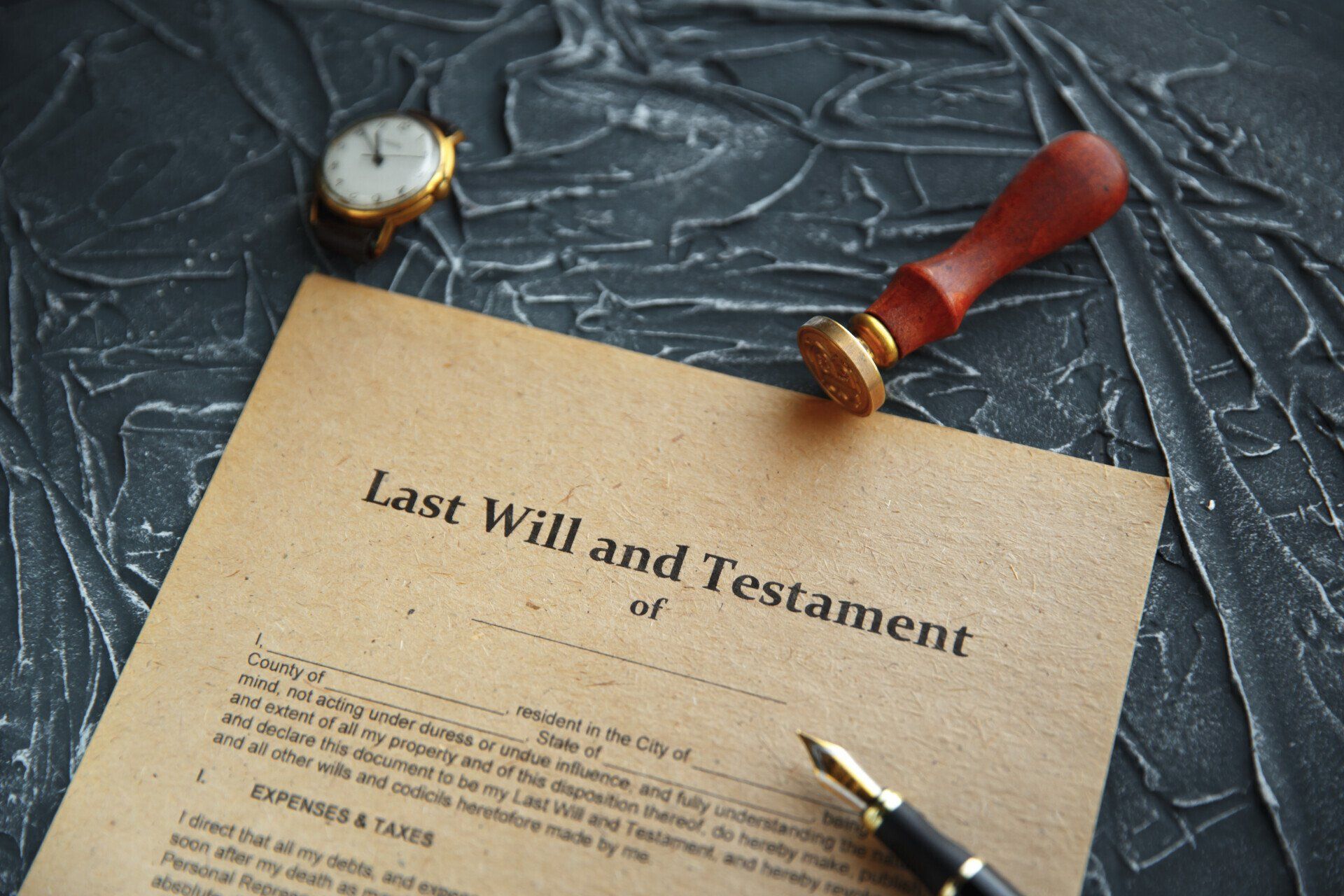

A will is the foundation document of estate planning. This is the set of instructions that an individual leaves behind. It tells the executor how to disperse the assets left behind. It also appoints a guardian for any minor children. A revocable trust is not needed by everyone. To find out if you do, you are encouraged to speak with a legal professional who specializes in estate planning.

For more information about planning your estate, a legal professional is a great source. Some estates are more complicated than others. The size of the assets is going to determine how much paperwork is going to be necessary. Business owners, for example, also have to think about succession planning. There are insurance and tax concerns to go over. Young adults have the time to complete this process in steps.